The start of a new year is the perfect opportunity to reassess your organization’s financial health and set new goals. With the right focus and strategies, 2025 can be a year of growth and stability for your small business. Here are five practical financial resolutions to help you thrive in the year ahead.

1. Create a Financial Forecast

A financial forecast acts as a roadmap for your business, helping you anticipate revenue, expenses, and cash flow. It’s a powerful tool to set realistic goals and plan for challenges.

How to get started:

-

-

-

Review your financial performance from 2024.

-

Set monthly revenue and expense targets for 2025..

-

Eliminate unnecessary subscriptions or services.

-

-

With a clear financial forecast, you can make more informed decisions and avoid surprises.

2. Review and Optimize Expenses

Regularly reviewing your expenses ensures your money is being spent wisely. Identifying areas of overspending or inefficiencies can free up resources for growth.

Steps to take:

-

-

-

Categorize your expenses and analyze trends from the past year.

-

Negotiate better rates with vendors or switch to cost-effective alternatives.

-

Eliminate unnecessary subscriptions or services.

-

-

Trimming excess costs can significantly improve your bottom line.

3. Invest in Financial Software

Technology can make managing your finances easier, faster, and more accurate. By investing in modern financial tools, you can save time and reduce errors.

What to consider:

-

-

-

Look for software that integrates with your existing systems.

-

Prioritize features like automation, real-time reporting, and scalability.

-

Evaluate user reviews and support options before committing.

-

-

The right software can help you stay on top of your finances and focus more on growing your business.

4. Focus on Profitability, Not Just Revenue

Growing your revenue is exciting, but profitability is what truly sustains a business. Shifting your focus to improving profit margins ensures long-term success.

Steps to improve profitability:

-

-

-

Analyze your most and least profitable products or services.

-

Adjust pricing strategies to reflect value.

-

Optimize operational efficiency to reduce costs.

-

-

A profitable business is a healthy business.

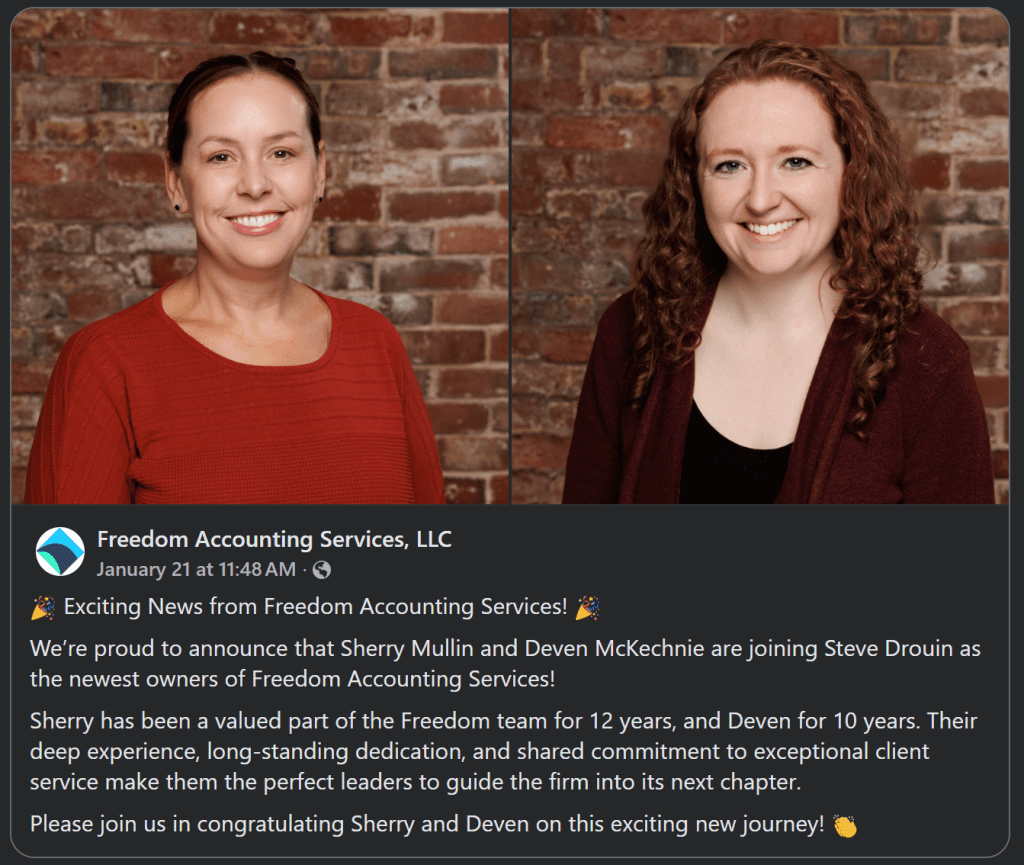

5. Partner with Financial Experts

Managing your business finances can be overwhelming, especially as your business grows. Working with a professional bookkeeping and accounting firm can give you peace of mind and allow you to focus on what you do best.

Benefits of working with experts:

-

-

-

Accurate financial records and reporting.

-

Strategic advice tailored to your business.

-

More time to focus on core business activities.

-

-

A trusted financial partner can make all the difference in achieving your goals.