AI is here to stay and can make a lot of things easier, especially in this fast-paced world. Who has time to run their business and then do the accounting? Sometimes AI isn’t as smart as we or “they” think they are, so why not use AI?

Why AI Isn’t Always the Answer: The Case for Staying Hands-on with Your Bookkeeping

AI is revolutionizing the accounting and bookkeeping world. From automated categorization to predictive cash flow, tools like QuickBooks and Xero are smarter than ever. But while these innovations promise speed and efficiency, they’re not a full replacement for human oversight, especially when it comes to the nuanced financial decisions that small businesses face daily.

Let’s explore why relying solely on AI can be risky, and why staying hands-on with your bookkeeping remains crucial.

- AI Lacks Business Context

AI tools process data based on predefined rules and past behaviors. But your business is constantly evolving. AI doesn’t know:

- Why a vendor expense was unusually high last month.

- That you’ve changed your business model or pricing strategy.

- Which clients are likely to delay payments based on relationships, not numbers.

Without context, AI can misclassify expenses (we see this a lot), miss anomalies, or misinterpret patterns. Human oversight is essential to connect the dots that AI cannot.

- Errors in, Errors Out

AI depends on accurate input. If your data is messy (like duplicate entries), mis-categorized accounts, or outdated vendor categories, then AI will process and automate errors just as quickly as correct entries.

Examples:

- Recurring subscriptions being posted to the wrong expense category.

- Personal transactions are misclassified as business expenses.

- Bank feeds syncing incorrectly without alert.

Hands-on review catches and corrects these mistakes before they become major reporting or tax time issues.

- Tax and Compliance Nuances

Tax laws are dynamic, and compliance often involves interpretation and judgment. AI can’t:

- Analyze how a local tax ordinance applies to your specific transaction.

- Make judgment calls about deductions or depreciation strategy.

- Proactively prepare documents that align with state specific filings.

Only a trained eye can flag risks and optimize compliance. AI tools may assist, but they don’t replace the role of a knowledgeable bookkeeper or advisor.

- You Miss the Story Behind the Numbers

Bookkeeping isn’t just about data entry; it tells the financial story of your business. When you’re hands on, you gain:

- A clearer view of how money flows in and out.

- Insight into what drives profitability.

- A gut sense of what’s normal and what’s not.

Business owners who remain engaged with their books are better equipped to make informed decisions. AI provides reports; humans extract meaning.

- No Substitute for Strategy

AI can automate transactions, but it can’t build strategy. It won’t:

- Recommend when to raise prices or cut costs.

- Suggest better payment terms with clients.

- Advise on cash flow planning ahead of seasonal slowdowns.

A hands-on bookkeeper or a financially involved business owner adds insight, foresight, and judgment that no algorithm can replicate.

- Risk of Overreliance

When automation runs without review, it creates a false sense of security. You assume the books are correct until a tax bill, loan rejection, or financial discrepancy proves otherwise.

By staying involved, you reduce risk and build resilience.

Final Thought

AI is a powerful tool, but not a turnkey solution. The most successful small business owners combine automation with attention using smart tools to save time, while maintaining regular reviews and strategic thinking.

Your books are more than numbers. They’re the roadmap to your business’ health and future.

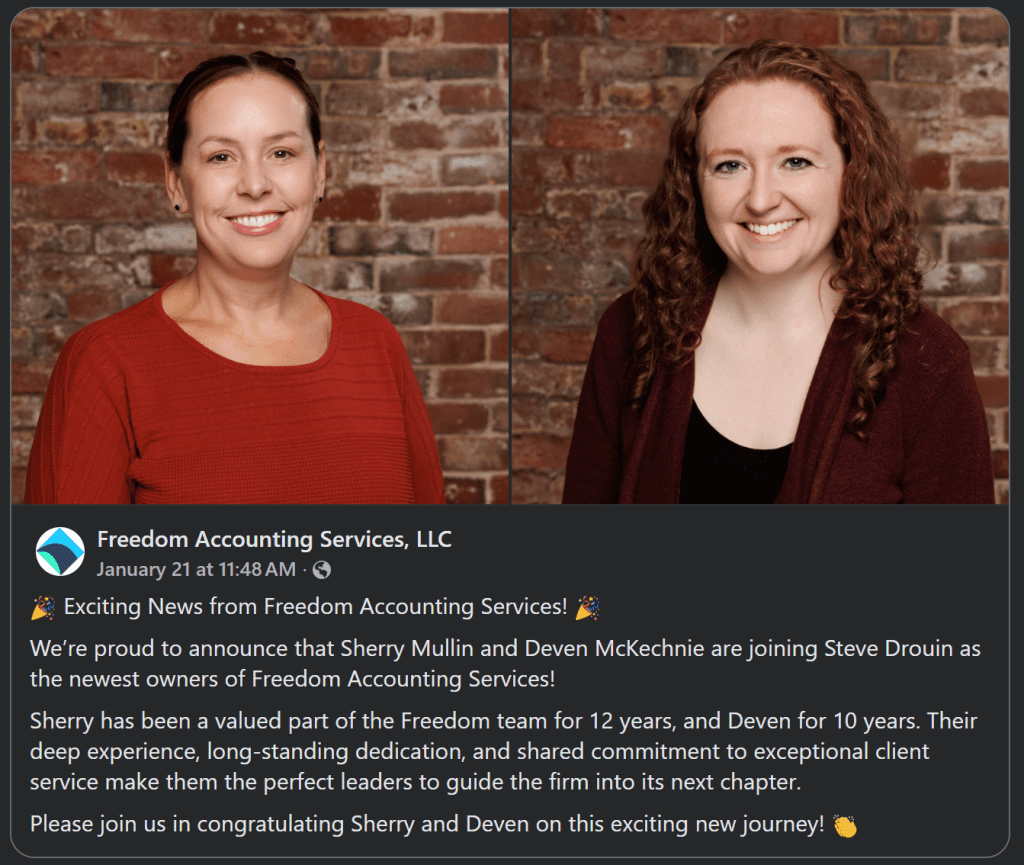

Need help keeping your books in check? Give us a call, or send us an email, we’re here to help, so you can focus on running your business.